I still spend five or six hours a day reading.

He spends as much as 80 percent of his day reading.

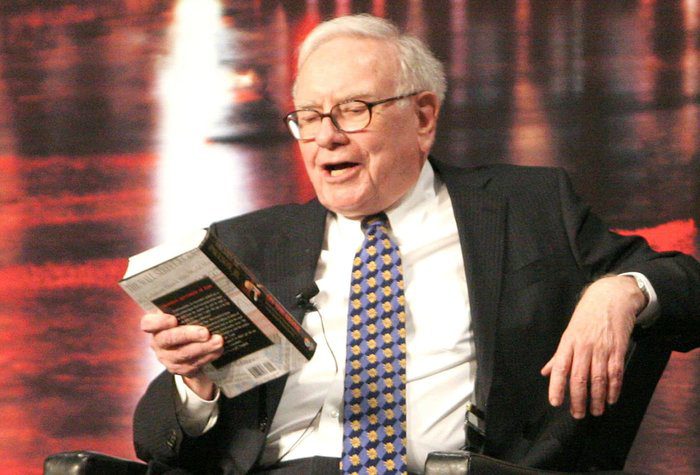

Warren Edward Buffett (born August 30, 1930) is an American investor, business tycoon, and philanthropist, who is the chairman and CEO of Berkshire Hathaway. He is noted for his adherence to value investing and for his personal frugality despite his immense wealth.

Warren Buffet has been the chairman and largest shareholder of Berkshire Hathaway since 1970. His business exploits have had him referred to as “Oracle” or “Sage” of Omaha by global media outlets. He is considered to be one of the most successful investors in the world.

- Warren starts every morning by poring over several newspapers and estimates he spends as much as 80 percent of his day reading.

- Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.

- I read and think, So I do more reading and thinking, and make less impulse decisions than most people in business. I do it because I like this kind of life.

Don’t sleepwalk through life. Don’t say it’s all going to be great. I’ll do this and I’ll do that, I’m just marking time until I get to be older. That’s like saving up sex for your old age. It is not a good idea.

Be a Learning Machine – Charlie Munger

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time—none. Zero. You’d be amazed at how much Warren reads—and how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”– Charlie Munger

In his 2007 Commencement Address to the graduating students at the University of Southern California Law School, Charlie Munger, vice chairman of Berkshire Hathaway advises the graduating students to be a learning machine-like Warren Buffet.

Wisdom acquisition is a moral duty.

And there’s a corollary to that proposition which is very important. It means that you’re hooked for lifetime learning, and without lifetime learning you people are not going to do very well. You are not going to get very far in life based on what you already know. You’re going to advance in life by what you’re going to learn after you leave here.

If you take Berkshire Hathaway, which is certainly one of the best-regarded corporations in the world and may have the best long-term investment record in the entire history of civilization, the skill that got Berkshire through one decade would not have sufficed to get it through the next decade with the achievements made.

Without Warren Buffett being a learning machine, a continuous learning machine, the record would have been absolutely impossible.

The same is true at lower walks of life. I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help—particularly when you have a long run ahead of you.

I was very lucky. I came to law school having learned the method of learning and nothing has served me better in my long life than continuous learning. And if you take Warren Buffett and watched him with a time clock, I would say half of all the time he spends is sitting on his ass and reading. And a big chunk of the rest of the time is spent talking one on one either on the telephone or personally with highly gifted people whom he trusts and who trust him. In other words, it looks quite academic, all this worldly success.

Warren On Reading:

It is fascinating what’s happened, just in my lifetime, in the 86 years. I should mention one thing about reading. It was at the library here at Columbia where I think I spent more time than any other student. I lived there, practically. I pulled a book out, which happened to be Who’s Who in America, and it told me something about my professor, Benjamin Graham. I went to the librarian and I said I want to learn more about this because I learned this over here. That changed my life. We own Geico now because of that librarian directing me to some other book and then me following through on that.

I went to the librarian and I said I want to learn more about this because I learned this over here. That changed my life.

I read at about one-fifth the pace that Bill does, but I still spend five or six hours a day reading. You can learn so much. I particularly love biographies ― to be able to live the lives of these people that have been so extraordinary, the lessons and the discouragements they faced ― everything about it. You can’t get enough of reading.

Source: Warren Buffett and Bill Gates Interview with Charlie Rose and answered student questions at Columbia Business School in 2017.

Start Early

Steve Forbes: You two are unique. In very different spheres you’ve each reached a level of success that’s almost legendary. What did you do that made you different?

Warren Buffett: Well, I was lucky that I got started early. My dad happened to be in the investment business, so I would go down to his office on Saturdays. At age 7 or so I started reading these books that were around the place. I knew what I wanted to do early. That’s a huge advantage.

“I’m no genius, but I’m smart in spots, and I stay around those spots. – Tom Watson (IBM)

Participant: I’m with the engineering school here at Columbia. You were talking about your love of reading. Do you have a particular book that changed your life, and the way you think about things, and also, what is the thing that you admire most about each other ― you, Bill, about Warren and the other way around?

Buffett: A book that changed my life was by a fellow that taught here at Columbia, Benjamin Graham, called The Intelligent Investor. I read it when I was 19. I had been interested in investment since I was maybe seven or eight, and I’d read every book in the Omaha public library by the time I was 11.

I had been interested in investment since I was maybe seven or eight, and I’d read every book in the Omaha public library by the time I was 11.

Rose: Why do you think you were interested in investing when you were seven or eight?

Buffett: Because I was too dumb to get interested at four! My dad had a small investment firm. I read all the books that he had there, waiting to go to lunch or whatever it might be, and then I went to the public library and read them all. It was a fascinating subject to me. I knew what everybody thought and all of that at an early age, but what Graham wrote made sense. I just happened to pick that book up in a bookstore in Lincoln, Nebraska.

On the book thing, I will tell you a wonderful book to read. I can tell you a number of them. Intelligent Investor, obviously, if you’re in the investment field, but Katharine Graham’s autobiography is a marvelous book. It’s by an incredible woman who had an incredible life and then wrote honestly about it.

Biography is my favorite. You can learn from other people and their mistakes.

Thinking Independently

- You have to be able to think independently, and when you come to a conclusion you have to really not care what other people say. Just follow the facts and your reasoning. That’s tough for a lot of people. But that part, I was just lucky with. I was born that way.

Luck

- I’ve had all kinds of luck. I had the luck of getting turned down by Harvard, which meant I got to study under Ben Graham at Columbia, which changed my life. All kinds of things have worked out. So I just hope I stay lucky. I’ve been lucky for 80 years.

- There’s lots of luck. Just being born in the United States in 1930 the odds were 30-to-1 against me. I didn’t have anything to do with picking the United States as I emerged. And having decent genes for certain things.

Stay on your Lane

- Knowing what to leave out is just as important as knowing what to focus on. Somebody said how to beat Bobby Fischer; you play him any game except chess. And so I don’t play Bobby Fischer at chess.

The best moat you can have is your own talent. They can’t take it away from you; inflation and taxes can’t take it from you.

I urge students when I talk to them to look at the people you admire and list what makes you admire them. Those are things that you should do. Just write them down.

On Fear of Failure

I would say this: don’t fear failure. I got turned down by Harvard. It’s one of the best things that ever happened, along with other good things that have happened that didn’t seem good at the time. Don’t worry about it, and don’t let it eat at you or look back. Just keep going because you’re going to have some things and forget them. Go forward.

Find what you Love

I advise students: as much as possible, look for the job that you would take if you didn’t need a job. Don’t sleepwalk through life. Don’t say it’s all going to be great. I’ll do this and I’ll do that, I’m just marking time until I get to be older. That’s like saving up sex for your old age. It is not a good idea.

Bill Gates on Warren Buffet

Charlie Rose: And Bill, what have you learned from him being associated with him (Warren Buffet) ?

Bill Gates: I also remember Warren showing me his calendar. You know, I had every minute packed and I thought that was the only way you could do things. And the fact that he is so careful about — he has days.

Charlie Rose: So it taught you what, not to crowd yourself too much and give yourself time to read and think and…

Bill Gates: Right. You control your time. And that sitting and thinking maybe a much higher priority than a normal CEO, where’s there all these demands and you feel like you need to go and see all these people. It’s not a proxy of your seriousness that you fill every minute in your schedule.

Warren Buffett: And people will want your time. I mean, it’s the only thing you can’t buy. I mean, I can buy anything I want, basically, but I can’t buy time.

Recommended/Mentioned Books

- The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham

- Personal History by Katharine Graham

- Essays In Persuasion by John Maynard Keynes

All the best in your quest to get to get better. Don’t Settle: Live with Passion.

4 Comments

Pingback: Top 30 Quotes on Lifelong Learning – Lanre Dahunsi

Pingback: Top 30 Quotes on Luck. – Lanre Dahunsi

Pingback: Lifelong Learning Hero: Charlie Munger – Lanre Dahunsi

Pingback: Labour Under Correct Knowledge. – Lanre Dahunsi