Book Title: The Age of Cryptocurrency: How Bitcoin and the Blockchain Are Challenging the Global Economic Order

Authors: Paul Vigna and Michael J. Casey

Print | Kindle(eBook) | Audiobook

In The Age of Cryptocurrency, Wall Street journalists Paul Vigna and Michael J. Casey write about Cryptocurrencies’ promise and challenges with special emphasis on Bitcoin. The authors posit that Bitcoin and other cryptocurrencies have the potential of becoming a generally accepted model of payment. Still, the technology and the pioneers need to work on the reputation and trust challenges of Bitcoin. They provide great information for newbies and cryptocurrency enthusiasts – the history of money, blockchain, the promise of eliminating middlemen, cryptocurrency mining, altcoin, government regulations, the opportunities, and the challenges of cryptocurrency.

Cryptocurrency adoption as a generally accepted mode of payment is fraught with challenges such as a been used a tool for money laundering, cybercrime, trust issue, proliferation of alternate coins (altcoin), Government regulation, among other challenges. I am still a little bit sceptical on cryptocurrencies but excited about the numerous opportunities and use cases of blockchain.

Favourite Take-Aways – Book Title: The Age of Cryptocurrency:

The Potential

Bitcoin is a groundbreaking digital technology with the potential to radically change the way we conduct banking and commerce, and to bring billions of people from the emerging markets into a modern, integrated, digitized, globalized economy. If it works—and that’s still a big if—an awful lot of things that today seem like part of the natural state of the world are going to look as antiquated as Gutenberg’s printing press.

By eliminating middlemen and their fees, cryptocurrency promises to reduce the costs of doing business and to mitigate corruption inside those intermediating institutions as well as from the politicians who are drawn into their prosperous orbit.

Distrupting the Banking System

The Cryptocurrency (Bitcoin) cuts away the middleman yet maintains an infrastructure that allows strangers to deal with each other. It does this by taking the all-important role of ledger-keeping away from centralized financial institutions and handing it to a network of autonomous computers, creating a decentralized system of trust that operates outside the control of any one institution.

Decentralized System of Trust

At their core, cryptocurrencies are built around the principle of a universal, inviolable ledger, one that is made fully public and is constantly being verified by these high-powered computers, each essentially acting independently of the others. In theory, that means we don’t need banks and other financial intermediaries to form bonds of trust on our behalf. The network-based ledger—which in the case of most cryptocurrencies is called a blockchain—works as a stand-in for the middlemen since it can just as effectively tell us whether the counterparty to a transaction is good for his or her money.

At its core, this technology is a form of social organization that promises to shift the control of money and information away from the powerful elites and deliver it to the people to whom it belongs, putting them back in charge of their assets and talents.

Satoshi Nakamoto – Creator of Bitcoin: A Peer-to-Peer Electronic Cash System

On November 1, 2008, a computer programmer going by the pseudonym Satoshi Nakamoto sent an email to a cryptography mailing list to announce that he had produced a “new electronic cash system that’s fully peer‐to‐peer, with no trusted third party.” He copied the abstract of the paper explaining the design, and a link to it online. In essence, Bitcoin offered a payment network with its own native currency and used a sophisticated method for members to verify all transactions without having to trust in any single member of the network. The currency was issued at a predetermined rate to reward the members who spent their processing power on verifying the transactions, thus providing a reward for their work. The startling thing about this invention was that, contrary to many other previous attempts at setting up a digital cash, it actually worked.

Nakamoto was the first to solve the double-spending problem for digital currency using a peer-to-peer network. Nakamoto was active in the development of bitcoin up until December 2010. Many people have claimed, or have been claimed, to be Nakamoto.

Aftermath of the 2008 Recession

At its core, cryptocurrency is not about the ups and downs of the digital currency market; it’s not even about a new unit of exchange to replace the dollar or the euro or the yen. It’s about freeing people from the tyranny of centralized trust. It speaks to the tantalizing prospect that we can take power away from the center—away from banks, governments, lawyers, and the tribal leaders of Afghanistan—and transfer it to the periphery, to We, the People.

While the wealth of hedge fund managers and other elites surged thanks to the relentless stock market gains after the financial crisis subsided in 2009, the incomes of most households in Western societies stagnated, creating the widest wealth gap since the Great Depression. It’s a story of big banks, big companies, and big homes for the 1 percent, with close to nothing left for the rest. That’s one of the features of our twenty-first-century economy, and it speaks to a trend of centralization, not decentralization.

Permissionless Blockchains – Bitcoin, Litecoin, Ethereum

Permissioned Blockchains – Ripple, Eris, Hyperledger

Blockchain Technology

At its core, bitcoin the technology refers to the system’s protocol, a common phrase in software terminology that describes a fundamental set of programming instructions that allow computers to communicate with each other. Bitcoin’s protocol is run over a network of computers that belong to the many people around the world that are charged with maintaining its core blockchain ledger and monetary system. It provides those computers with the operating instructions and information they need to keep track of and verify transactions among people operating within the bitcoin economy.

The system employs encryption, which lets users key in special passwords to send digital money directly to each other without revealing those passwords to any person or institution. Just as important, it lays out the steps that computers in the network must perform to reach a consensus on the validity of each transaction. Once that consensus has been reached, a payee knows that the payer has sufficient funds—that the payer isn’t sending counterfeit digital money.

“Trust is at the core of any system of money. For it to work, people must feel confident that a currency will be held in the right esteem by others.”

The Nixon Shock

America, hobbled by the cost of the Vietnam War and unable to compete with cheaper foreign producers, couldn’t bring in enough foreign currency with which to restock its gold reserves and so started to run out of them as countries such as France demanded that their dollars be redeemed for the precious metal.

Feeling trapped, President Richard Nixon took the stunning step on August 15, 1971, of taking the dollar off the gold peg. He did so with an executive order that was designed in consultation with just a handful of staffers from the Treasury, the Fed, and the White House.

Now that the dollar was no longer pegged to gold, banks could take their credit-creation business global, setting the stage for the globalization of the world economy. It also paved the way to the multinational megabanks that would become too big to fail … and all the problems these would create.

Crypto Mining

Bitcoin’s software is preprogrammed to generate a consistent amount of new bitcoins over a 130-year period, and that these are issued as rewards to computer owners known as miners for their work confirming transactions. Over time, as the generation of new bitcoins slows, the reward system will shift to one in which miners are compensated with modest transaction fees imposed on anyone making payments.

Altcoins (Litecoin, Dogecoin, GoCoin, Ethereum etc)

Altcoins, as they came to be known, would use the same or similar aspects of bitcoin’s system, all made possible because of bitcoin’s open-source protocol and its lack of an owner. Anybody can download the software, copy it, and build something new from it. Lawsuits for copyright or patent infringement are simply not a concern.

Some are dubious-looking projects, quite blatant pump-and-dump schemes. Some aren’t really competitors to bitcoin at all because they exist for the purpose of creating new forms of decentralized commerce through blockchain technology.

Challenges of Bitcoin

Security

Remember, bitcoin functions very much like cash. Once it is sent, it is sent; there’s no way to get it back, no chargebacks like those that credit-card companies impose on merchants when they discover they’ve sold goods to someone with a stolen card. As with cash, if your bitcoins are stolen, that’s it. You can’t retrieve them—unless, of course, the thief is caught.

Price Volatility

Another big concern is price volatility. Nobody wants to go to the grocery store week to week and see her bill change 10 percent or more just because the underlying bitcoin exchange rate is fluctuating. Until we live in a bitcoin-based economy, where the digital currency is the unit of account in which prices are quoted, this exchange-rate fluctuation will be unavoidable in everyday life for bitcoin-using payers and payees.

Enomormous Carbon Footprint

There’s no way to calculate the total energy used by the bitcoin mining network, but that hasn’t stopped some from trying. Back in April 2013, various press reports recounted that bitcoin was consuming 131,000 megawatt hours a day, at a daily cost of $19.7 million.

Months later, Guy Lane, an Australian environmental scientist, came up with his BitCarbon method for calculating the carbon footprint of bitcoin. Based on his assumption that a bitcoin miner will on average spend 90 percent of the value of the mined bitcoin on electricity, Lane calculated that a $1,000 bitcoin price would result in 8.2 million tons of carbon per year, about the size of Cyprus’s emissions, and that a $100,000 bitcoin price would produce 825 megatons annually, or the equivalent of Germany’s emissions.

If the bitcoin’s currency exchange rate ever got to $1 million, a number that some argue is feasible if bitcoin becomes a world-dominant payment system, its network would have a carbon footprint of 8.2 gigatons, or 20 percent of the planet’s carbon output.

If bitcoin becomes a world-dominant payment system, its network would have a carbon footprint of 8.2 gigatons or 20 percent of the planet’s carbon output.

China

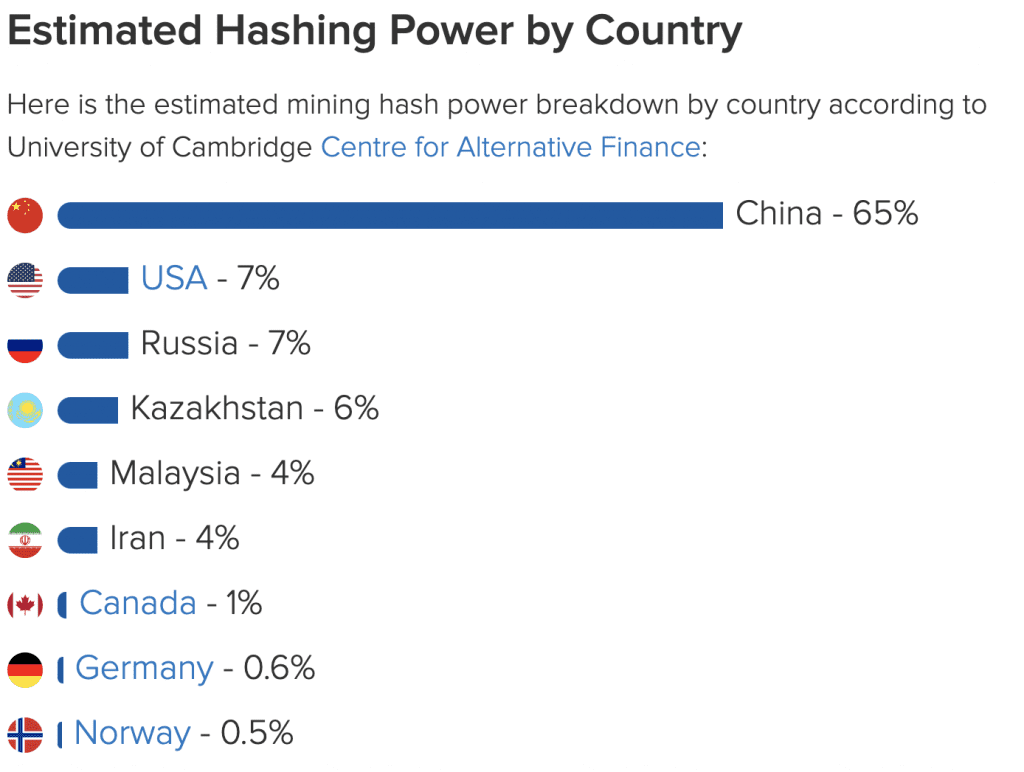

Chinese trading volumes outstrip those seen anywhere else in the world. Demand from China was the main factor behind bitcoin’s vertical climb to a peak above $1,100 in December 2013, and mining activity in China has been estimated to account for 30 percent of all hashing power. (That could change if subsidies for coal power plants are removed, driving up the cost of electricity.) But again, this is all about speculating. While plenty of venture capitalists are looking at China, and a few are investing in local bitcoin exchanges and mining operations, almost no VC or angel money is being invested in merchant businesses or payment processing.

51% Attack

A 51% attack is a potential attack on a blockchain network, where a single entity or organization is able to control the majority of the hash rate, potentially causing a network disruption.

Mt Gox

Mt. Gox was a bitcoin exchange based in Shibuya, Tokyo, Japan. Launched in July 2010, by 2013, and into 2014 it was handling over 70% of all bitcoin (BTC) transactions worldwide, as the largest bitcoin intermediary and the world’s leading bitcoin exchange. Mt. Gox announced that approximately 850,000 bitcoins belonging to customers and the company were missing and likely stolen, an amount valued at more than $450 million at the time.

Silk Road

Silk Road was an online black market and the first modern darknet market, best known as a platform for selling illegal drugs. In October 2013, the Federal Bureau of Investigation (FBI) shut down the website and arrested Ross Ulbricht under charges of being the site’s pseudonymous founder “Dread Pirate Roberts”. Ulbricht was convicted of seven charges related to Silk Road in the U.S. Federal Court in Manhattan and was sentenced to life in prison without the possibility of parole.

In November 2020, the United States government seized more than $1 billion worth of bitcoin connected to Silk Road.

Authors Conclusion

These days more than ever, technology is driving the twin processes of human discovery and the struggle for freedom. True to the spirit of Gutenberg’s invention, information technology now fully occupies the engine room. For information truly is power. The telegraph, telephone, and later television all helped spread ideas and shift power away from those who’d previously monopolized information. Then came the Internet, which has amplified this effect to new extremes, giving people more power than they’ve ever had. Whatever you want to call this new economy—the sharing economy, the collaborative economy—it is upending centuries of accepted social norms.

Cryptocurrency, a pure form of information technology, a deliberately, explicitly disruptive form of information technology, promises to take things to a new level altogether. The decentralized bitcoin network and its public ledger, the blockchain, are at their essence a radical new way of dealing with information. In this case, it takes information about monetary transactions and economic exchanges out of the hands of monopolist institutions and creates a decentralized mechanism for society to judge the validity of that information. Thus cryptocurrency can claim to be the latest in a long line of technological developments that have shifted power out of the hands of centralized elites and handed it over to the people.

The bigger part of cryptocurrency’s cultural makeup will be found in the parts of the wider economy into which it meshes, both the traditional economy and the new-age sharing economy. Eventually, we believe, this transformation will happen, and all will be changed. Bitcoin will end up something less than the stateless, third-party-less utopian dream of its most passionate supporters. But the creaking, crashing banking state will have some much-needed competition and discipline forced upon it. Costs will come down, commerce and economic activity will grow along digital lines that transcend the lines on a map, and the world will seem even smaller than it already does.

Comments are closed.